How Do I Apply for Medicaid?

How Do I Apply for Medicaid?

Medicaid eligibility can no longer be obtained retroactively for up to 3 months as in previous years (the law changed February 1, 2019). This means you must have your Medicaid application in by 5:00pm on the last day of the month to be considered for benefits for that month. Planning in order to meet Medicaid’s income requirements should be done before you submit an application for Medicaid. Contact us to request a Medicaid consultation with one of our attorneys to discuss your situation and let us help you.

What Assets Can I Have and Still Qualify?

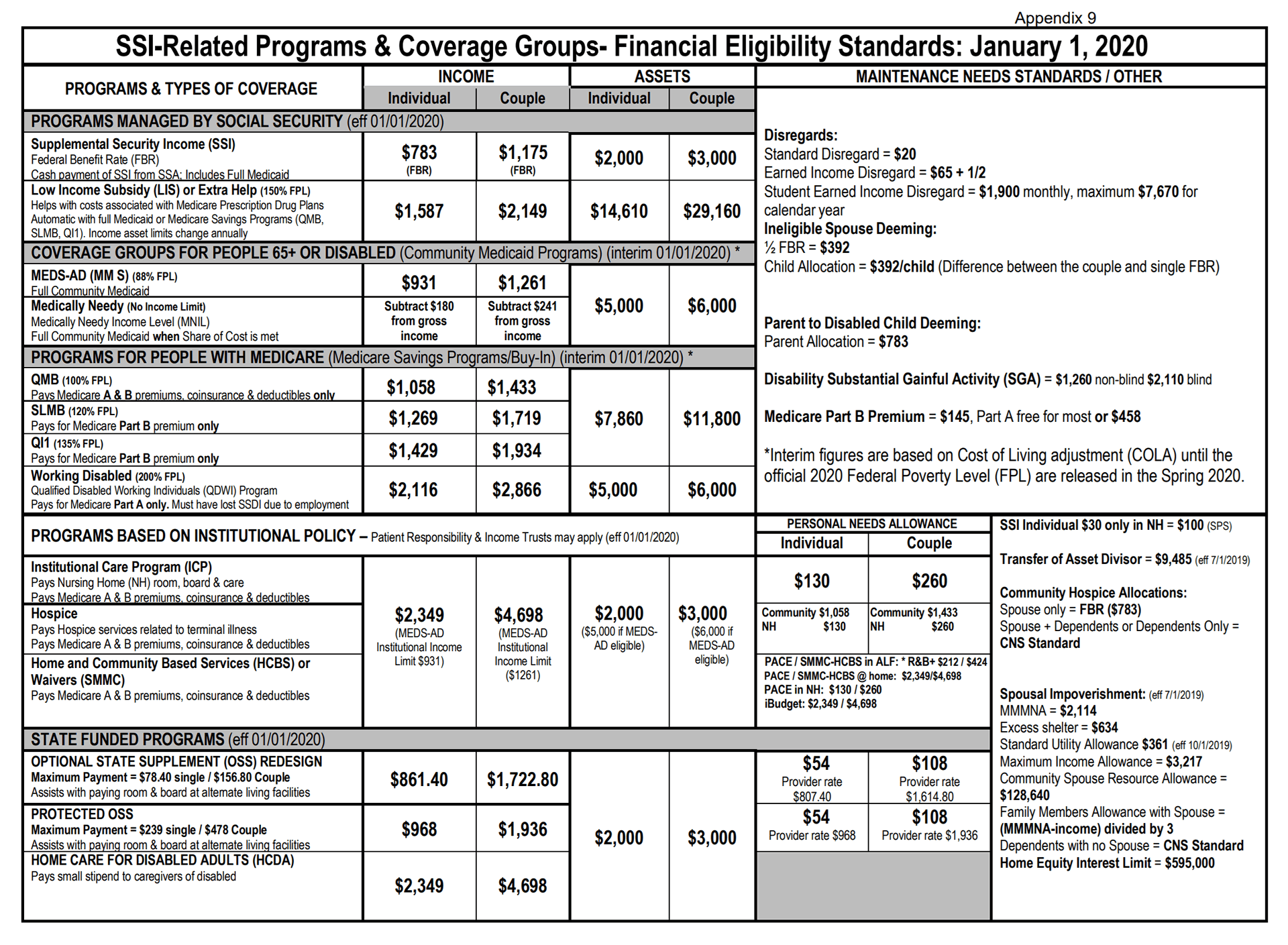

As of January 01, 2020, an individual applicant must have an income less than $2,349 per month. A car of any value, prepaid burial plans/plots and irrevocable funeral plans, personal effects and furnishings, and a burial account with a cash value up to $2,500 will not be counted as an asset. Medicaid laws count a homestead of greater than $595,000 in value as an asset, which would require spend-down, in most cases. A spouse may have assets up to $128,640. A Medicaid Applicant may have $2,000 in assets. The law allows for a minimum and maximum income to be diverted to the spouse still living at home. Contact us for additional details on qualification requirements.

What if I Have More Assets or Income than is Allowed?

A Qualified Income Trust (QIT) can be used to hold excess income and assist in meeting the qualifications. Contact us to inquire about a QIT. Be cautious about using annuities for asset protection or giving away assets. Balloon annuities were commonly used prior to the Medicaid laws enacted in Florida in November 2007. Now Balloon Annuities are allowed only under limited circumstances and require naming the State of Florida as the primary beneficiary. Medicaid also has a look-back period preventing applicants from giving away assets as an effective form of qualification. The transfer penalty is calculated based on total amount of assets transferred during the 5 year look back period prior to receiving a Medicaid Application. For every $9,485 of non-exempt transfers made, the Applicant will be ineligible for Medicaid benefits for 1 month. Attorneys are the only ones who can give you this advice.

Commonly CPAs and Financial Advisors recommend gifting the annual gift exclusion amount ($15,000 as of 2020) to one or multiple people, which is acceptable for tax purposes but often creates a penalty for Medicaid.

Please contact us today to schedule a consultation to discuss your situation and options for Medicaid Planning.

What are VA Aid and Attendance Benefits?

Aid and Attendance is a benefit paid by Veterans Affairs (VA) to veterans, veteran spouses or surviving spouses. It is paid in addition to a veteran’s basic pension. The benefit may not be paid without eligibility to a VA basic pension. Aid and Attendance is for applicants who need financial help for in-home care, to pay for an assisted living facility or a nursing home. It is a non–service connected disability benefit, meaning the disability does not have to be a result of service. You cannot receive non–service and service–connected compensation at the same time. Aid and Attendance benefits are paid to those applicants who:

- Are eligible for a VA pension

- Meet service requirements

- Meet certain disability requirements

- Meet income and asset limitations

Who is Eligible for Veterans Affairs Basic Pension and Aid and Attendance?

A pension is a benefit that the VA pays to wartime veterans who have limited or no income and who are at least 65 years old or if under 65, are permanently or completely disabled. There are also “Death Pensions,” which are needs based for a surviving spouse of a deceased wartime veteran who has not remarried.

What are the Service Requirements for Aid and Attendance?

A veteran or the veteran’s surviving spouse may be eligible if the veteran:

- Was discharged from a branch of the United States Armed Forces under conditions that were not dishonorable AND

- Served at least one day (did not have to be served in combat) during the following wartime periods and had 90 days of continuous military service:

- World War I: April 6, 1917, through November 11, 1918

- World War II: December 7, 1941, through December 31, 1946

- Korean War: June 27, 1950, through January 31, 1955

- Vietnam War: August 5, 1964 (February 28, 1961, for veterans who served “in country” before August 5, 1964), through May 7, 1975

- Persian Gulf War: August 2, 1990, through a date to be set by Presidential Proclamation or Law.

If the veteran entered active duty after September 7, 1980, generally he/she must have served at least 24 months or the full period for which called or ordered to active duty (there are exceptions to this rule).

What are the Disability Requirements for Aid and Attendance?

Veterans, spouses of veterans or surviving spouses can be eligible for Aid and Attendance benefits if they meet the following disability requirements:

- The aid of another person is needed in order to perform personal functions required in everyday living, such as bathing, feeding, dressing, toileting, adjusting prosthetic devices, or protecting himself/herself from the hazards of his/her daily environment; or

- The claimant is bedridden, in that his/her disability or disabilities require that he/she remain in bed apart from any prescribed course of convalescence or treatment; or

- The claimant is in a nursing home due to mental or physical incapacity; or

- The claimant is blind, or so nearly blind as to have corrected visual acuity of 5/200 or less, in both eyes, or concentric contraction of the visual field to 5 degrees or less.

What are the Income Requirements for Aid and Attendance?

The claimant’s countable family income must be below a yearly limit set by law. Countable Income means income received by the claimant and his or her dependents. It includes earnings, disability and retirement payments, interest and dividends, and net income from farming or business. A claimant must report all income, but the VA will exclude any income that the law allows. Public assistance, like SSI, is not counted as part of countable income. The annual income limits for the Aid and Attendance program are higher than those set for the basic pension. The maximum Aid and Attendance benefit that can be paid monthly to a single veteran is $1,881.42, but the veteran must have countable income of $0 to receive the maximum benefit.

The following chart includes the set yearly income rate/annual pension Aid and Attendance limit set by Congress; it also includes the maximum monthly benefit:

| Aid and Attendance Maximum Annual Pension Rate (MAPR) Category if you are a… | Annual Basic Pension MAPR | Annual Housebound Benefits | Annual Aid & Attendance Benefits |

| Single Veteran (with no dependents) | $13,752 | $16,805 | $22,938 |

| Veteran with Spouse/ Dependent Child* | $18,008 | $21,063 | $27,194 |

| * add $2351 for each additional child | |||

| Surviving Spouse | $9,223 | $11,273 | $14,761 |

| **These numbers are all subject to change. Last update effective 12.01.2019 |

Unreimbursed Medical Expenses

A portion of unreimbursed medical expenses paid by claimants may reduce the countable income.

Unreimbursed medical expenses include: cost of a long term care institution or assisted living, health related insurance premiums (including Medicare premiums), diabetic supplies, private caregivers, incontinence supplies, prescriptions and dialysis not covered by any other health plan. Only the portion of the unreimbursed medical expenses that exceed 5% of the basic pension MAPR may be deducted.

What are the Asset Requirements for Aid and Attendance?

Net Worth (the value of your assets) also affects eligibility. VA pensions are a need–based benefit, and a large net worth might affect your eligibility. All personal goods are exempt from the net worth. These goods include the home you live in, a vehicle used for the care of the claimant, and household goods and personal effects such as clothes, jewelry and furniture. In October, 2018 the VA established a maximum non-exempt asset limit to determine eligibility of $127,061.

What if I have too many assets?

A VA Accredited Attorney can assist you in establishing an Irrevocable Trust. Currently, there a 3 year look back period to make transfers to an Irrevocable Trust. The VA Applicant and his/her spouse can not be the Trustee of beneficiary of this Irrevocable Trust in order for assets to be excluded from consideration when applying for benefits. Often, children or other close family members are named as the Trustee and Income beneficiary of the trust.

What do I do with my house?

Although homestead is generally exempt from consideration for VA benefits and/or Medicaid the proceeds of the sale of a home may disqualify applicants from benefits they have previously qualified for! Contact us today to discuss option with any homestead property.

Can an insurance agent help me with VA benefits?

Only a VA Accredited attorney or Veteran Service Organization Representative (VSO) may assist in the application of benefits. The Florida Supreme Court recently ruled on this matter and held that it constituted the unlicensed practice of law for a non-lawyer to engage in Medicaid or VA planning.

Furthermore, in order to assist with VA planning or claims an attorney must be specifically accredited with the VA. Every attorney at Murphy & Berglund, PLLC is VA Accredited and can assist you with your VA Benefits Analysis.